Investments & Talent Across Sectors - Middle-East & North Africa Region

Amarjeet Dutta and Bala Kumaran

Investments & Talent Across Sectors - Middle-East & North Africa Region

Resilient Middle-East & North Africa Region

Even as the pandemic roiled global economies, the Middle-East & North Africa (MENA) region stood out, in not only weathering the storm but attracting private investments across the region. Private capital promises to be a critical element of the region's recovery. These investments also were coupled with active portfolio management and interventions from the private equity investors. Sectors like Fintech, e-Grocery, Ed-Tech, and Healthcare attracted significant capital and are likely to attract top talent. Combined with the confluence of positive macroeconomic drivers such as the upswing in oil prices and geopolitical stability, the region has bounced back smartly.

Middle East – Beacon of hope

Some of the world's biggest investors are based in the Middle East, with the ten largest institutions in the region managing combined investments of US$3.71 trillion. Policymakers have made rapid strides in improving the regulatory framework following the collapse of Abraaj Capital. Reflecting the improved regulatory framework, investment managers are seeing an encouraging number of breakthroughs in their effort to draw foreign and organic capital to the Middle East.

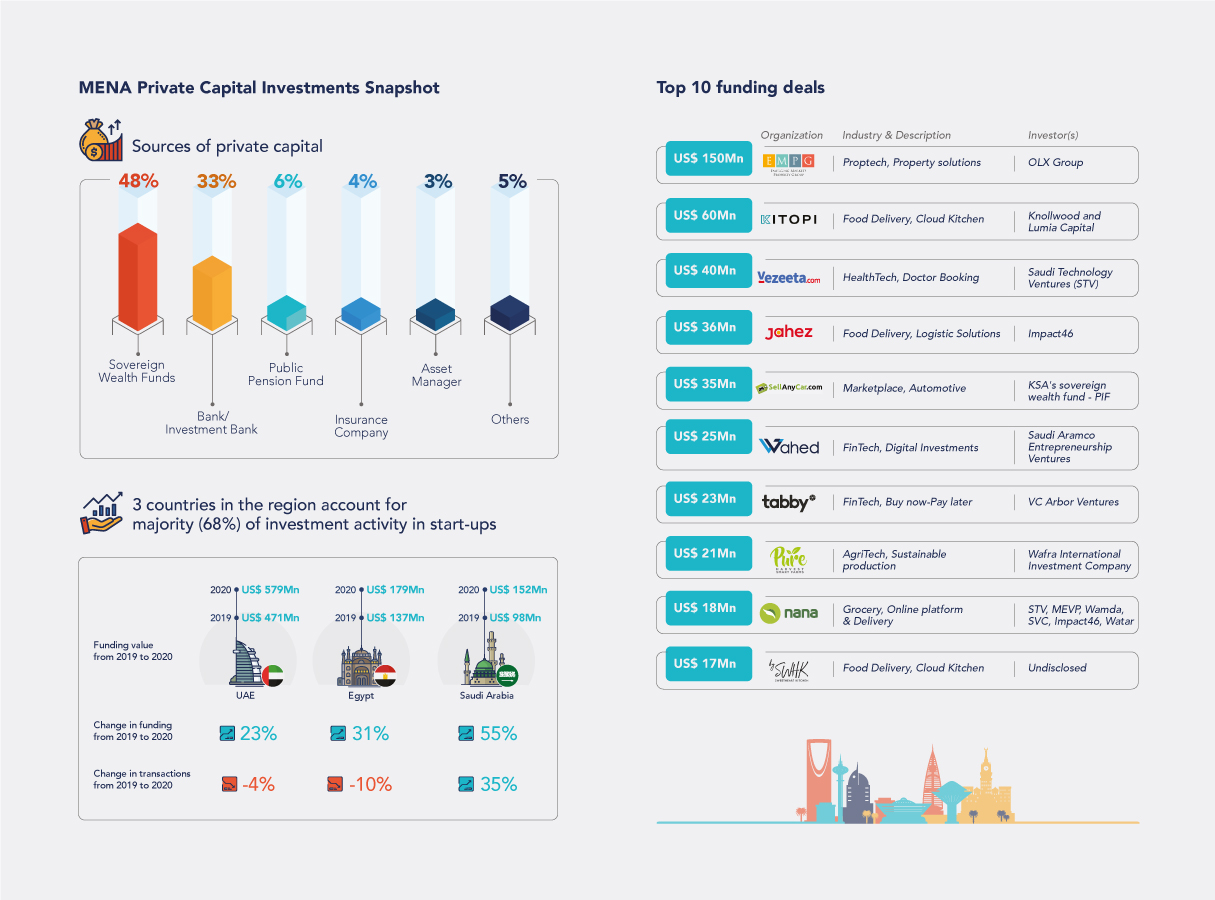

It is estimated that private capital assets under management in the MENA region have decreased from US$349 billion in 2019 to US$253 billion in 2020. Recovering from a low, however, it is expected to rise at 11.1 percent CAGR by 2025. The estimated forecast reflects the restoration of investor confidence in the region, and the region's outperformance of growth over global growth (9.8 percent) reveals the depth of confidence put in the recovery. Despite the pandemic, venture funds showed signs of continued growth in the MENA region. 2020 saw a record of over US$1 billion invested in MENA-based start-ups, a rise of 13 percent year-on-year, while the number of deals decreased 13 percent from last year. The small decline in volumes but increase in absolute value reflects the sentiment that investors are prepared to make larger but more vigilant bets. This is further verified by looking at the change from pre-seed investments (deal sizes up to US$100K) to larger-ticket investments in Seed & Series A (US$100K-US$3M). 47 percent of all transactions were less than US$100K in 2019, and this figure plummeted to 27 percent in 2020. The US$1 billion is guided more by the first half (US$723M) vs. the second half (US$563M), likely suggesting that pre-pandemic transactions were agreed and realized in Q1 & Q2 of 2020. The markets started to show signs of growth from Q4 of 2020. Industries such as E-Commerce & FinTech, which saw increased demand due to the pandemic, held top slots, followed by healthcare.

Transition from passive evaluator to active player

Investors and fund managers were largely akin to the 'King' on a chessboard, the most important piece where all the plays surrounded them. However, during the pandemic, the investors in the region took more of the 'General' role on an Asian GO board, the attacking piece, while being mindful of health and safety. The pandemic demonstrated the importance of effective risk management with progressive investors willing to turn their Environment, Social, and Governance (ESG) assessments to support C-level executives in portfolio companies with informed advice and directions to survive as well as brace against the storm.

The majority of investors helped their portfolio companies address leadership gaps that arose because of the pandemic across three facets:

Governance and Operations Support

Directing portfolio companies to examine the organizational health situation and pivot directives strategically to maintain the top line, cut losses, review balance sheet items, preserve and regulate cash flows. Furthermore, some of them did just justice to their position by executing modifications in roles and responsibilities of key stakeholders along with effective talent alterations wherever applicable.

Digital acceleration/transformation

Mandating leaders to immediately adopt an effective digital mindset that needs to be a horizontal system rather than an isolated vertical function.

Managing remote workforce

Sharing best practices on remote working through tech-enabled communication platforms, executing mental wellbeing initiatives, directing constant communication to shareholders and executive management teams to ensure seamless governance.

To address the gaps, the C-suite executives of portfolio companies and funded start-ups had to be malleable in financing, efficient in operations, and agile in decision-making. In exchange, investors had to navigate the fine line between evaluating and setting priorities without over-interfering with an increasingly volatile working environment.

Key Sectoral Snapshots

Healthcare

Current climate: There is a spike in the investments by the GCC Member States extensively in healthcare companies with a predicted boom in medical tourism. Healthcare providers are switching to hybrid models with a focus on digital and pharmacy distribution. The funds generated in start-ups in healthcare more than tripled in 2020 (+280 percent) as against 2019.

Growth triggers: In addition to a transition from largely public to private sector paradigms, health awareness with an alarming proliferation of lifestyle-related diseases and a growing population are key triggers. Needless to say, strategies to mitigate COVID-19 pandemic’s impact are paramount, which also significantly triggered various growth engines in the healthcare sector.

Impact on leadership talent & trends: Throughout the GCC, major investment and growth ventures are an ongoing phenomenon, leading to increased demand for C-suite expertise, particularly those who understand the local health ecosystem. An uptick in the Import of high-quality healthcare professionals (technical & commercial) is a vivid observation.

Key areas of increased talent demand: Telemedicine, Healthcare logistics, R&D.

FMCG & Retail

Current climate: In 2020, record sales were registered in packaged foods, consumer health, and home care, led largely by the increased demand for essential goods compared to ‘aspirational (non-essential) and luxury purchases’. The COVID-19 pandemic highlighted the sector's focus on the emergence of Omni channels (offline to online) and the need to strengthen distribution and avenues for end customers. Furthermore, e-grocery and FMCG e-commerce obtained substantial investments in 2020, comprising 13% of all the originated deals.

Growth triggers: Despite the dependency on imported goods, retailers could reliably monitor and maintain prices. Seamless logistical connectivity, a mature e-commerce ecosystem with accelerated deliveries allowed the digitally savvy population to continue to make advancements in this space. Combined with technology-driven innovations in last-mile distribution, increased focus on Omnichannel offerings, and breadth of convenience offered for customers, this sector looks highly propitious in the times to come.

Impact on leadership talent & trends: With challenges in the supply chain, distribution, and fulfillment of FMCG & retail, leadership talent with strong digital/technology skills that allows organizations to leap-frog rather than ‘play catch-up’ are in high demand to fuel the inevitable growth.

Key areas of increased talent demand: Cloud Kitchens, Food/Goods Delivery, Grocery Marketplace, App Aggregators/Super Apps companies.

Telecommunications & Technology

Current climate: With the growth of global smartphones and VoIP apps, Middle Eastern member states have to a certain extent relaxed IT, core tech, and infrastructure regulations to make it easier for the industry and unfold future possibilities. In the Pre-COVID era, restructuring and M&A activity was extensive, which did slow down in Q1 & Q2 of 2020. With the Abraham Accord and other Geo-synergies, it will be an interesting era of the entire Telecommunications and Technology space going ahead.

Growth triggers: For both policymakers and businesses in the region, data privacy and cybersecurity issues become a top priority. Key sectors such as healthcare, consumer goods, and finance accentuating their dependence on technology infrastructure will further fuel the upward trajectory.

Impact on leadership talent & trends: There is a benign transfer of leadership talent from the IT industry with increased investment in technology to various industries, allowing room for the potential influx of new talent, especially in product, innovation, and engineering functions.

Key areas of increased talent demand: Cybersecurity, International Handoffs, Data Center connectivity, and storage.

BFSI & Fintech

Current climate: In terms of both investment and top-line growth, the banking, finance, and insurance companies saw the highest growth surge. The FinTech sector was the biggest beneficiary, representing more than 15 percent of the funding mainly raised in the digital payments arena.

Growth triggers: With digital service transformation, InsureTech, neo-banking, fraud detection, risk analysis, application of AI to personalize banking services, ’anywhere banking’, and other innovations, Fintech is poised to grow further. Much akin to the consumer sector, BFSI is also experiencing an extensive shift toward Omnichannel offerings and prioritization of customer convenience and experience.

Impact on leadership talent & trends: With diverse finance ecosystems, particularly FinTech in the UAE, KSA, Bahrain, and Kuwait, leadership expertise is in demand across retail banking functions, digital banking functions that recognize the complexities of current subsystems and work tenaciously to simplify them.

Key areas of increased talent demand: Digital investments, Core Technology Architecture, ‘Buy-now Pay-later schemes’, Regulation & Government Affairs.

Real Estate

Current climate: Although the real estate sector was the mainstay sector in the MENA region for years, it suffered from fluctuations in real estate prices before COVID-19. Amidst the pandemic, it saw an over-supply problem which prompted organizations to recalibrate their approach. Although with recent government directives and major developers scaling back cautiously, unabsorbed inventory was at the lowest level in 2020 compared to the last 8 years in the region.

Growth triggers: Real estate investors are placing crucial bets on assets that will be augmented after the economy somewhat settles down to normalcy. Changes in the behaviors of end-users towards risk-averse investments, leasing vs. outright purchase, switching to lower density locations, etc., will affect the sector growth in the coming years. Much like other sectors, technology continues to play a key role in real estate through property aggregators, pre-fabricated unit developers, etc.

Impact on leadership talent & trends: Driven primarily by family offices, large private funds, and sovereign wealth funds, the demand for leadership expertise in this field is still very consistent to pre-COVID levels. There is an observed shift towards competent techno-commercial leaders with proven skill sets in binding organizations together and having high levels of financial acumen.

Key areas of increased talent demand: Property Portals, Vertically Integrated Organizations (Property acquisition & management, construction & development and classified portals), Business Development.

Education

Current climate: It would not be too far-fetched to claim that COVID-19 has changed the Middle East education sector, especially in the GCC. The pandemic has highlighted the importance of technology in higher education. For established educational institutions across all stages, e-learning has become a standard pillar, and Edutech businesses made considerable advances last year.

Growth triggers: Previous bottlenecks like lack of provisioned laptops/tablets offerings and internet penetration has improved. Sustained efforts by the governments across the region in favor of shifting towards online/digital education are promising. This is substantiated by the increasing number of start-ups in the Edutech Space and the highest ever funding received up to US$20 million across 29 deals.

Impact on leadership talent & trends: The industry is at a nascent stage of 2-3x year-on-year growth, and the need for talent is very evident, particularly at leadership levels with an emphasis on driving scale and profitability and ensuring the delivery of world-class education digitally.

Key areas of increased talent demand: K-12 learning, Executive Education, B2B Edutech.

War for talent redux

Investments in the GCC region and the MENA region as a whole, especially now with greater political stability in the region, will continue to rise. EMA Partners is actively engaged with private capital investors and portfolio firms providing tailored human capital interventions. We at EMA Partners, believe that capitalizing on an imminent growth period with robust business & talent strategy to back it up, will be most critical for companies looking to bolster growth in the immediate and near future.

References: Investments & Talent across Sectors – Middle East & North Africa Region

Insights

Our Insights are the research and leadership trends that will benefit both clients and candidates, and inspire them to become better professionals